Patent Grants and Accumulated Annuities

Published on 5 September 2017

In patent lingo, the term "accumulated annuities" (also known as "back taxes") refers to Intellectual Property annuity fees for a pending patent

application that are retrospectively paid at the time of grant, along with the patent grant or registration or issue fees (if applicable).

Failure to pay back taxes will result in the serious consequence of the lapsing of the granted patent. The main advantage of a patent system

with back taxes is its friendliness on an applicant’s pocket; the annuities need to be paid only if a patent is granted.

The estimation of back taxes can be complicated and challenging, as the amount to be paid depends on the time taken to grant, which, in turn, varies

from one jurisdiction to another. In the United Kingdom, for instance, there will be no accrual of annuities for patents granted within three years

and nine months (i.e. 45 months) from the date of filing. The due date for the payment of the first annuity is four years from the filing date or

three months from the date of grant, whichever is later. Therefore, if a patent is filed on January 1, 2017, and granted on November 1, 2021,

the back taxes in respect of the fifth and the sixth years need to be paid within three months from the date of grant.

As the amount of back taxes can be high in certain jurisdictions, it is advisable to estimate the amount beforehand so as to avoid being

shocked at the time of grant. While talking about the best practices for managing

global IP budgets at the Marcus Evans IP Law Summit in September 2016, Cheryl L. Huseman (Senior IP Counsel, Chevron Phillips Chemical Company LP)

referred to such challenges. She said, "There's been a big increase in the annuities that we get charged up to the time the patent gets allowed." Further,

she also mentioned that Chevron Phillips forecasts its budget four years in advance and that there is no guarantee or certainty of

the pending patent applications in the company’s portfolio at the time of budgeting being granted within the subsequent four years.

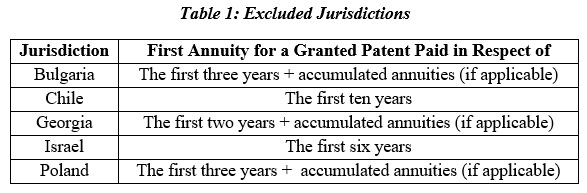

The legislations in 39 jurisdictions across the globe mandate the payment of back taxes. Included in this figure are four jurisdictions

that are ranked within the top 25: the United Kingdom, Russia, India, and Spain. Further, this figure excludes certain jurisdictions

in which annuities for a certain number of years are to be compulsorily paid at the grant stage irrespective of the year of grant (Table 1).

We considered only the jurisdictions within the top 75 positions2 (excluding Thailand and Uzbekistan) for further analysis.

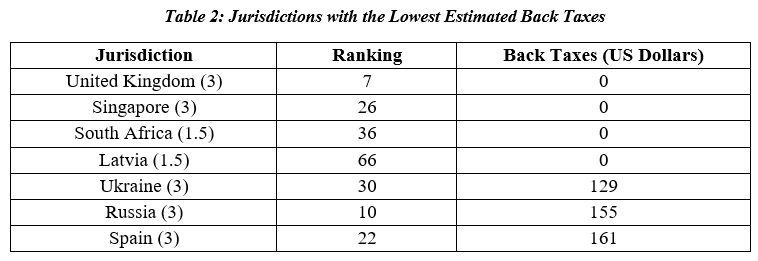

The jurisdictions with the lowest back taxes (<$175) are listed in Table 2 (the number within parentheses indicates the average time taken to

grant in years, based on our research). The estimates are inclusive of attorney charges. No back taxes are required to be paid in 55%

of the jurisdictions, including the United Kingdom. Further, two BRICS (Brazil, Russia, India, China, and South Africa) nations are included

in the seven jurisdictions.

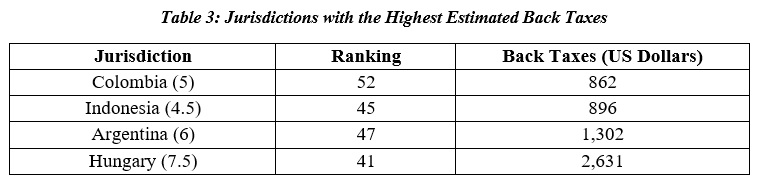

At the other end of the spectrum, the estimated back taxes (including attorney charges) exceed $850 in four jurisdictions (Table 3).

It's quite surprising that the advanced economy of Hungary takes more than 7 years to grant a patent.

The estimated average time taken to grant across the jurisdictions listed in Table 3 (5.75 years) is more than twice the average time

taken to grant across the jurisdictions listed in Table 2 (approximately 2.6 years). This could be one reason why the back taxes

are higher for the jurisdictions listed in Table 3.

The back taxes are very high (>$1,200) in the jurisdictions of Argentina and Hungary, with the back taxes in the latter being twice that in the former.

Interested in getting similar estimates? Quantify IP's carefully designed flagship software solutions estimate the costs for either a single

patent family (the Global IP Estimator) or an entire patent portfolio (the Portfolio Estimator - Patents). The costs are estimated based on

our meticulous research of patent legislations in 150+ jurisdictions. Specific stages of the patenting process (filing, examination, prosecution,

grant, and maintenance) can be included or excluded from the estimates.

To know more, email us at

qipcontact@quantifyip.com, or call +1-808-891-0099.

You'll be surprised at how much time and money you can save by having more insight into your Intellectual Property portfolio.

Let us help you unlock that potential. Reach out today for a free demo.

Venkatesh Viswanath (Senior Analyst, Quantify IP) contributed to this article.

1 - The phrase "back taxes" has been taken from http://www.asiaiplaw.com/article/41/2450/

2 - Rankings taken from WIPO's World IP Indicators 2016; and

3 - Based on PATSTAT data for applications filed between 2000 and 2015

for assistance.

for assistance.